ELECTRONIC NEWS HIGHLIGHT W21.2025

1. Renesas expands semiconductor footprint in India with new R&D centers and new startup academy partnership

Renesas Electronics said it has partnered with India’s Ministry of Electronics and Information Technology (MeitY) to strengthen the local semiconductor ecosystem by supporting startups and academic institutions under the “Chip to Startup” (C2S) program.

As part of this initiative, Renesas has signed two memorandums of understanding with the Center for Development of Advanced Computing (C-DAC), which focuses on driving innovation in VLSI and embedded systems. The agreements include providing development tools, Altium Designer software, and technical training to both startups and universities to promote product engineering and hands-on learning.

Renesas also marked a milestone with the inauguration of expanded offices in Bengaluru and Noida, consolidating its R&D and sales operations. The new Bengaluru facility, now Renesas’ largest in India, will house approximately 500 employees, including teams from newly acquired Altium and Part Analytics. The Noida facility will focus on automotive computing solutions, in particular Renesas’ R-Car SoC platform.

India is a priority market for Renesas due to its skilled engineering talent and growing domestic demand. The company aims to generate more than 10% of its global revenue from India by 2030 and plans to increase its local workforce to 1,000 by the end of 2025. The partnership reflects Renesas’ commitment to long-term investment in the Indian semiconductor industry.

Learn more: Renesas expands semiconductor footprint in India with new R&D centers and new startup academy partnership

2. Murata expands Vietnam plant to meet growing demand for automotive inductors

Murata plans to build a new production building at its facility in Ho Chi Minh City, Vietnam, to expand inductor output amid growing demand from the automotive and electronics industries.

The expansion, scheduled to begin in May 2025, will add 10,576 square meters of floor space and is expected to be completed in the first half of 2026. The company will invest about 3 billion yen, including construction and production equipment.

Murata said the project is part of the company’s long-term strategy to strengthen its supply capacity for passive components used in vehicles, power management systems and high-frequency communications. The move highlights Vietnam’s growing role in the global electronics manufacturing network. The new building will be dedicated to coil production, helping to ensure stable supply in the medium to long term for global customers in the automotive and ICT industries.

Learn more: Murata expands Vietnam plant to meet growing demand for automotive inductors

3.Top 10 OSAT vendors post modest growth in 2024 amid rising demand for advanced packaging

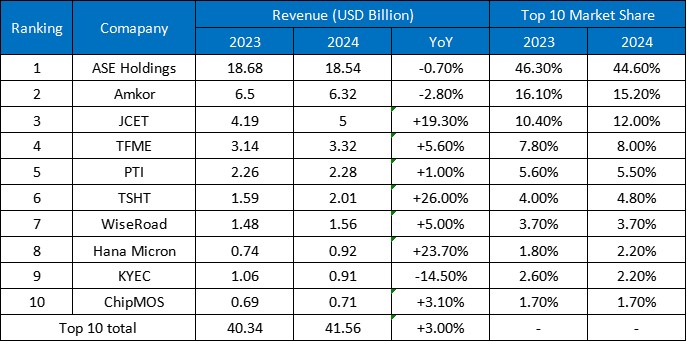

According to a report by research firm TrendForce, the world’s top 10 outsourced semiconductor assembly and test (OSAT) service providers will generate $41.56 billion in revenue by 2024, up 3% year-on-year.

Despite modest growth, the OSAT sector is undergoing a transformation driven by advanced packaging demand and regional dynamics. ASE Group retained its top spot with $18.54 billion in revenue, accounting for nearly 45% of the top 10. Amkor Technology ranked second with $6.32 billion, down 2.8% due to a weak recovery in the automotive electronics sector due to slow auto sales and inventory adjustments.

China-based JCET ranked third, posting a 19.3% increase in revenue to $5 billion. The company benefited from improving consumer electronics demand and platform upgrades in AI PCs and mid-range smartphones, which helped fill its standard packaging capacity. Tongfu Microelectronics took fourth place with $3.32 billion, up 5.6%, supported by a recovery in the communications and consumer markets and strong performance from AMD.

TrendForce notes that the 2024 OSAT market reflects broader transformation trends across the entire semiconductor supply chain. Increasing requirements for high-density, high-frequency packaging driven by AI and edge computing are accelerating the adoption of wafer-level packaging, heterogeneous integration, die stacking, and advanced testing.

This shift is repositioning OSAT companies from traditional contract manufacturers to advanced technology companies, making the packaging industry a strategic core of the semiconductor ecosystem.

Learn more: Top 10 OSAT vendors post modest growth in 2024 amid rising demand for advanced packaging

#ASEAN #AsiaPacific #distributor #Global #electronicdistributor #PCBA

English

English  Tiếng Việt

Tiếng Việt